What Expenses To Capitalize . a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. They let a company avoid incurring a large expense. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. Capitalized costs are incurred when. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs.

from ufreeonline.net

a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. Capitalized costs are incurred when. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. They let a company avoid incurring a large expense. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic.

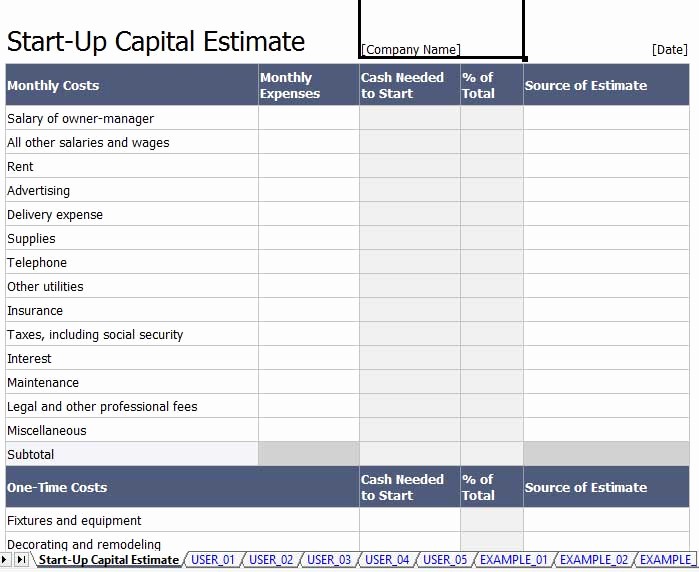

50 Startup Expenses And Capitalization Spreadsheet

What Expenses To Capitalize They let a company avoid incurring a large expense. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. They let a company avoid incurring a large expense. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. Capitalized costs are incurred when. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. Capitalized costs are incurred when. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. They let. What Expenses To Capitalize.

From www.investopedia.com

Capitalize What It Is and What It Means When a Cost Is Capitalized What Expenses To Capitalize capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. learn how to distinguish between capitalizing and. What Expenses To Capitalize.

From slideplayer.com

Analyzing Financial Statements ppt download What Expenses To Capitalize the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. They let a company avoid incurring a large expense. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. capitalized costs are expenses incurred to put fixed assets to use and intangible. What Expenses To Capitalize.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting What Expenses To Capitalize the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. costs are. What Expenses To Capitalize.

From www.investopedia.com

How do capital and revenue expenditures differ? What Expenses To Capitalize the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. Capitalized costs are incurred when. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce. What Expenses To Capitalize.

From exofdpbhd.blob.core.windows.net

Pros And Cons Of Capital Costs at Armanda Rael blog What Expenses To Capitalize They let a company avoid incurring a large expense. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. the primary costs that companies can capitalize under ias 2 include purchase and conversion. What Expenses To Capitalize.

From www.xfanzexpo.com

Capital Expenditures Definition, Overview And Examples Throughout What Expenses To Capitalize costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. They let a company avoid incurring a large expense. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. learn how to distinguish between capitalizing and expensing costs. What Expenses To Capitalize.

From www.financereference.com

Capitalize vs Expense Finance Reference What Expenses To Capitalize capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. They let a company avoid incurring a large expense. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic. What Expenses To Capitalize.

From www.peterainsworth.com

Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an. What Expenses To Capitalize.

From efinancemanagement.com

Financial Management Concepts in Layman's Terms What Expenses To Capitalize capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. learn how. What Expenses To Capitalize.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize capitalized costs are expenses incurred to put fixed assets to use and intangible asset costs. Capitalized costs are incurred when. a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. They let a company avoid incurring a large expense. a capitalized cost is. What Expenses To Capitalize.

From www.peterainsworth.com

Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. They let a company avoid incurring a large expense. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. capitalized costs are expenses incurred to put fixed assets. What Expenses To Capitalize.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. Capitalized costs are incurred when. learn how to distinguish between capitalizing and expensing costs based on their useful. What Expenses To Capitalize.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. capitalized costs are expenses incurred to. What Expenses To Capitalize.

From www.cougarboard.com

The proper way to capitalize expenses. What Expenses To Capitalize a capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance sheet. learn how to distinguish between capitalizing and expensing costs based on their useful life assumption. Capitalized costs are incurred when. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. costs. What Expenses To Capitalize.

From efinancemanagement.com

Capitalizing Assets Define, Example, Matching Concept, Fraud, Benefits What Expenses To Capitalize Capitalized costs are incurred when. They let a company avoid incurring a large expense. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. the primary costs that companies can capitalize under ias 2 include purchase and conversion costs. a capitalized cost is an expense added to the. What Expenses To Capitalize.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet What Expenses To Capitalize a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. Capitalized costs are incurred when. a capitalized cost is an expense added to the. What Expenses To Capitalize.

From news.marketcap.com

Capital Expenditure (CapEx) Definition, Formula, and Examples What Expenses To Capitalize a capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic. Capitalized costs are incurred when. costs are capitalized (recorded as assets) when the costs have not been used up and have future economic value. the primary costs that companies can capitalize under ias. What Expenses To Capitalize.